The snow finally stopped sometime overnight. The street is quiet again. Plows have passed, sidewalks are half-cleared, and most people are still inside, waiting for ice to melt and power to fully settle.

That’s when the phone rings.

Or a text buzzes in. Or there’s a knock at the door from someone you’ve never seen before, offering to “help” — right now — before things get worse.

When storms create chaos, scammers rely on one thing above all else: pressure. The goal isn’t just to take money. It’s to rush you before you have time to call a family member, check a source, or simply say, “I’ll think about it.”

What follows are the most common snowstorm-related scam messages and pitches seniors report after severe winter weather — and the warning signs that can help you shut them down before they do any harm.

1. Door-to-Door Snow Removal Scams

This one spikes immediately after a storm.

How it works

- Someone knocks and says they’re “already in the neighborhood.”

- They offer to clear snow right now for cash.

- They may demand payment upfront — or do a half-job and disappear.

Red flags

- Cash only

- No written price

- No business name or truck markings

- Pressure like “I’ve got other houses waiting”

Why seniors are targeted

Limited mobility + urgency + icy conditions.

2. Fake Roof, Gutter, or Tree Damage Claims

Often paired with fear.

How it works

- A stranger claims your roof, chimney, or trees are “dangerous.”

- They may show blurry phone photos — not your actual home.

- They push immediate repairs to “prevent collapse.”

Red flags

- “You can’t wait on this” language

- Refusal to let you call family or get another estimate

- Asking for a large deposit

3. Utility Company Impostor Scams

Very common during outages.

How it works

- Call or text claiming to be electric, gas, or water company.

- Threatens shutoff unless payment is made immediately.

- Requests gift cards, Zelle, or prepaid debit cards.

Reality check

Utilities do not:

- Demand immediate payment by phone

- Ask for gift cards

- Call during a declared emergency to threaten shutoffs

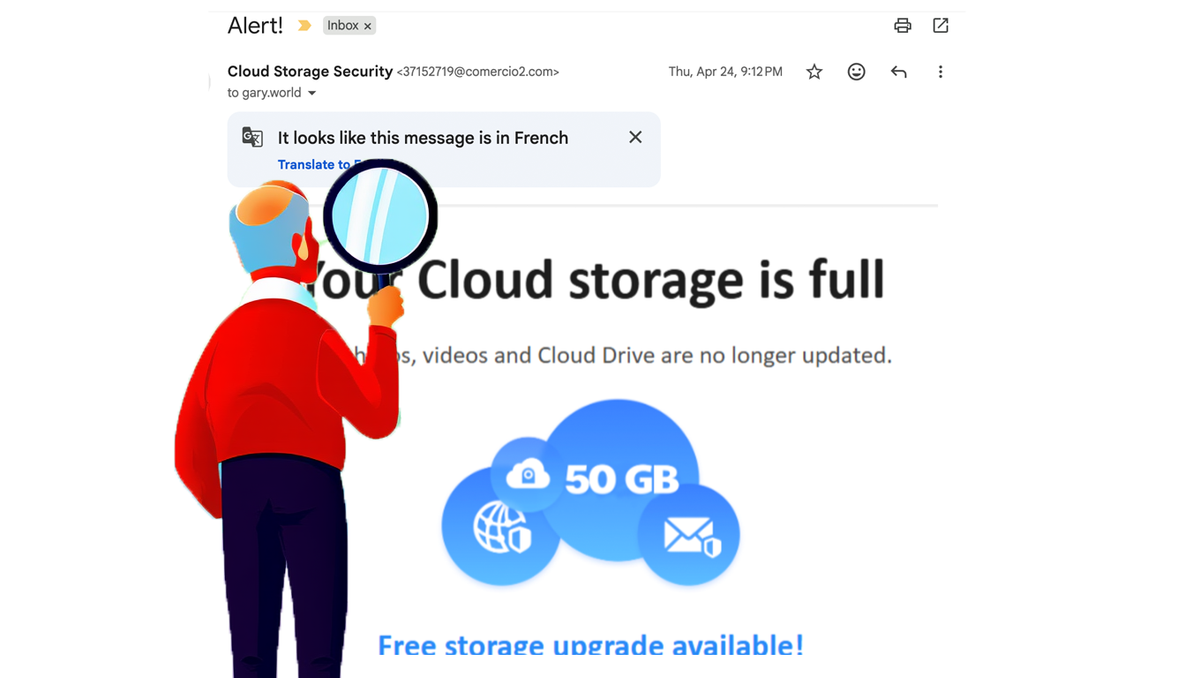

4. “Emergency Contractor” Phone Calls

Storm damage lists get sold fast.

How it works

- Caller says your name is on a “storm damage list.”

- Claims they’re approved by FEMA or insurance companies.

- Pushes inspections or deposits.

Red flags

- You didn’t request help

- They claim to represent government agencies

- High-pressure timelines

5. Fake Winter Relief & Charity Scams

Especially after news coverage.

How it works

- Appeals for donations to help “storm victims,” seniors, or utility relief.

- Often use names similar to real charities.

- Donation links lead to fake sites.

Red flags

- Emotional pressure (“people will freeze tonight”)

- No clear charity registration

- Requests for wire transfers or gift cards

6. Insurance “Help” Scams

These pop up after damage reports.

How it works

- Someone claims to “handle your claim faster.”

- Asks for policy numbers or login info.

- May file fake claims or steal identity details.

Red flags

- Asking for full Social Security numbers

- Promising guaranteed payouts

- Asking to “sign over” insurance checks

🧊 One Simple Rule That Prevents Most Storm Scams

Nothing legitimate requires instant payment during an emergency.

If someone pressures you to:

- Pay right now

- Decide on the spot

- Keep it secret

That’s the scam.

🧠 Smart Senior Safety Tips

- Don’t open the door to unsolicited workers

- Call a trusted family member before agreeing to repairs

- Use local, verifiable companies only

- Never pay in gift cards or cash

- Let storms pass before making decisions

Disclaimer: This article is for general informational purposes only and is not intended as legal, financial, or insurance advice. Scam tactics change frequently, and no list can cover every situation.

If you believe you’ve been targeted by a scam, contact your local consumer protection agency, your state Attorney General’s office, or the Federal Trade Commission at reportfraud.ftc.gov. When in doubt, pause and verify before taking action.