If you’re 60 or older, the odds of running into a scammer depend partly on where you live.

A new data analysis from All About Cookies examined the FBI’s Internet Crime Complaint Center (IC3) Elder Fraud Reports and found that complaints jumped again in 2023 after two years of decline.

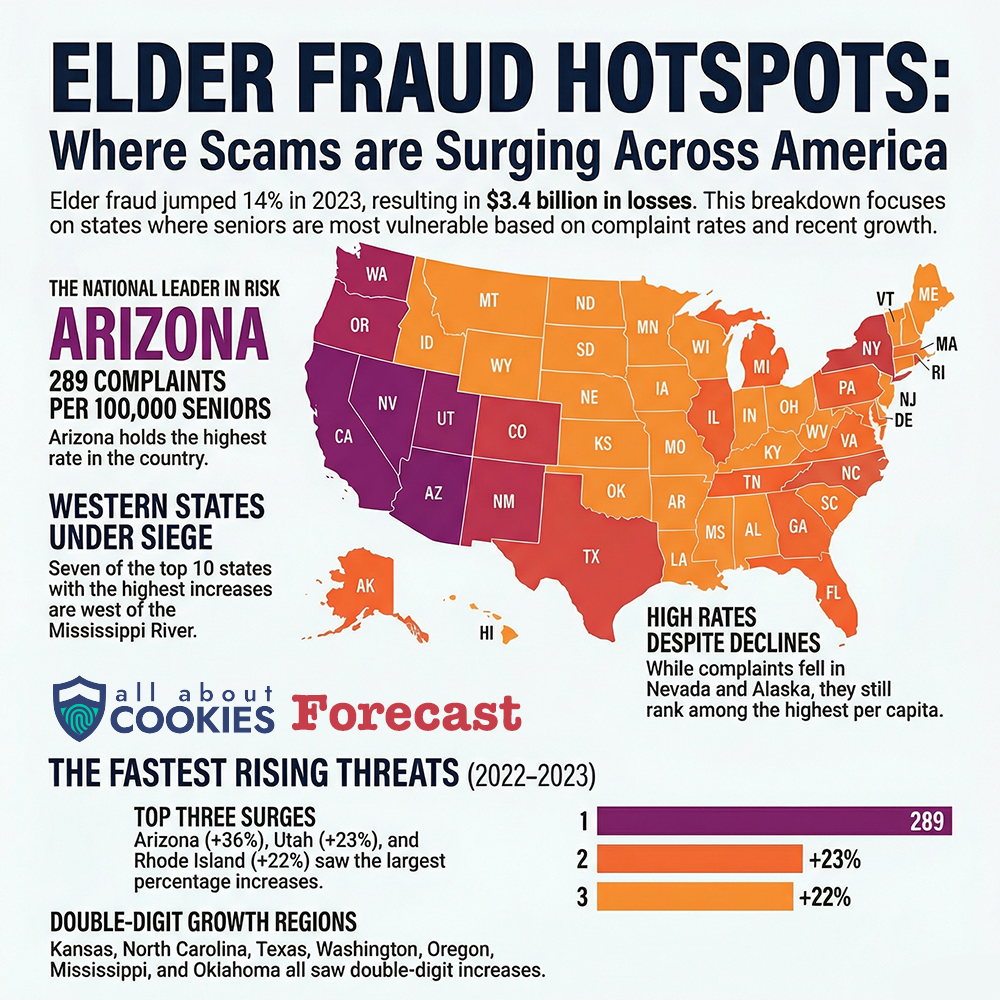

According to the FBI, Americans lost more than $12.5 billion to cybercrime in 2023. Of that, seniors accounted for over $3.4 billion in losses.

“Specifically, elder fraud increased by 14% in 2023, costing over $3.4 billion in losses for some of our most vulnerable citizens,” the authors write in the report.

That’s not exactly pocket change, is it?

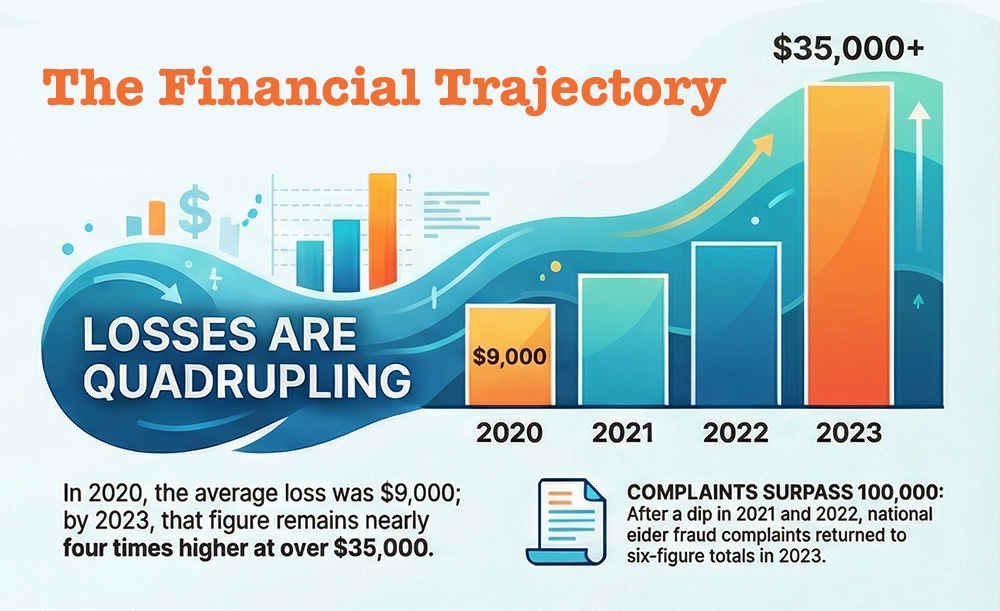

And if you get caught up in one of these schemes, plan on eating eating beans and rice for a while. The average loss per senior case hit $36,490 in 2023 — up 3% from the previous year.

States Where Elder Fraud Is Rising Fastest

All About Cookies analyzed FBI data from 2022 and 2023 and calculated complaints per 100,000 seniors using Census data.

The biggest increases:

1. Arizona (+36%)

Arizona moved from 212 complaints per 100,000 seniors in 2022 to 289 in 2023 — the highest rate in the country. The state added more than 100,000 residents age 60+ in a single year.

2. Utah (+23%)

Planning a move to Utah? Well, you should know that the Beehive State jumped from 145 to 179 complaints per 100,000 seniors.

3. Rhode Island (+22%)

Complaints rose from 82 to 100 per 100,000 seniors.

Kansas, North Carolina, Texas, Washington, Oregon, Mississippi, and Oklahoma also saw double-digit increases.

The authors note that seven of the top 10 states with the highest increases are west of the Mississippi River.

Not Every State is Moving in the Wrong Direction

Maine (-16%) and Vermont (-16%) saw the largest declines.

New Jersey followed at -15%.

Still, even in states where complaints fell, losses remain high. Nevada and Alaska both posted declines — but still rank among the highest complaint rates per capita.

The Bigger Trend Seniors Should Know

More troubling is how much money scammers are extracting.

“In 2020, the average elder fraud case resulted in a little over $9,000 lost,” the report notes. By 2022, that figure had climbed to more than $35,000. Even with a slight dip in 2023, losses remain nearly four times higher than in 2020.

What This Means for Smart Senior Daily Readers

Scammers follow opportunity.

States with rapidly growing retirement populations — like Arizona and Texas — are especially attractive targets.

That doesn’t mean seniors should panic. It means staying alert matters more than ever.

Basic protections still go a long way. AllAboutCookies tech gurus shared their best bets with Smart Senior Daily:

- Use strong, unique passwords (a password manager helps).

- Turn on bank and credit alerts. (read about the one thing almost every consumer fails to do to protect themselves when it comes to bank and credit card alerts)

- Be skeptical of urgency — especially investment or romance pitches.

We’ll continue tracking elder fraud trends and breaking them down for SSD readers — because protecting your money is protecting your independence.

Disclaimer: This article is for informational purposes only and is not legal or financial advice. Data is based on FBI IC3 reports analyzed by All About Cookies. Scam risks and complaint rates may change year to year. Always consult trusted professionals regarding financial or cybersecurity decisions.

You can read the full methodology and state-by-state breakdown in the complete All About Cookies report, authored by data journalist Josh Koebert, whose work has appeared in CNET, PCMag, Forbes, and TechCrunch.