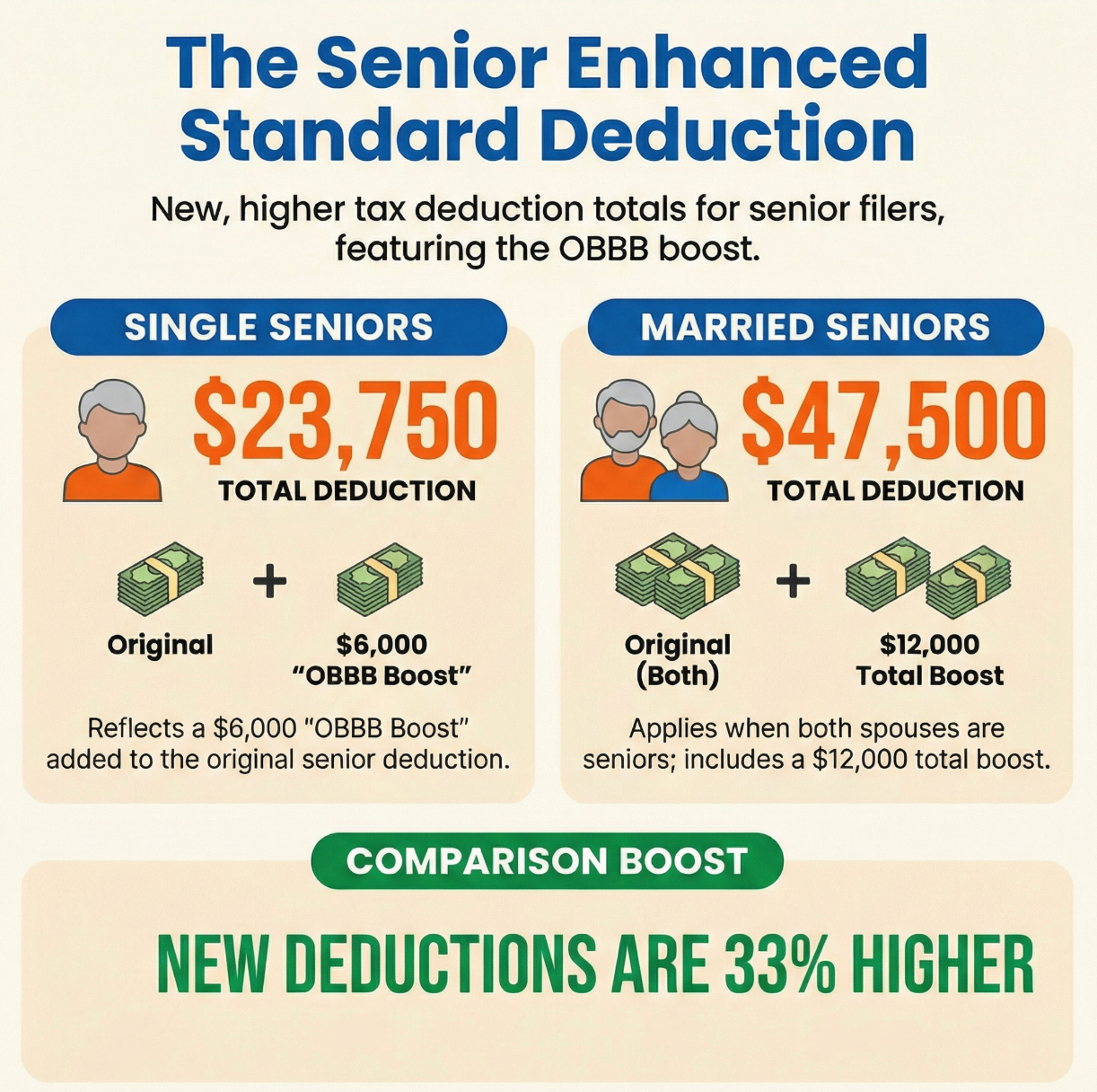

A new federal tax deduction — created by the One Big Beautiful Bill Act — allows eligible seniors to deduct up to $6,000 (that would be $12,000 for a married couple) from their taxable income each year through 2028.

This graphic explains what the nuts and bolts are of what is supposed to happen from SSD's research.

How the Deduction Works

The senior deduction is in addition to the standard deduction and the existing extra standard deduction for people 65+. That means taxpayers who qualify can reduce their taxable income even more than before — potentially lowering their total tax bill or increasing their refund.

Here’s how it plays out:

- Eligible age: You must be 65 or older by the end of the tax year to claim the senior deduction.

- Income phase-out: The deduction phases out for individuals with modified adjusted gross income (MAGI) over $75,000 ($150,000 for joint filers).

- Marriage benefit: A married couple where both spouses are 65+ can potentially claim up to $12,000 (two $6,000 deductions).

- Tax filing: You can claim the deduction whether you itemize or take the standard deduction — no separate form is required beyond checking your age on your return.

According to CBS News, this tax break could boost refunds for many seniors by an average of about $670, and in some brackets, even more.

🔽 Questions to ask your tax preparer before your appointment

1. “What do you need from me to confirm I qualify for the new age-65 deduction?”

This prompts the preparer to confirm age eligibility and income limits upfront — and to flag anything that could disqualify or reduce the deduction.

What they’ll likely want:

- Proof of age (birth date already on file, Social Security records)

- Filing status (single vs. married filing jointly)

- Estimated income sources for the year

2. “Does my income put me near the phase-out range — and if so, what paperwork matters most?”

This helps determine whether documenting all income accurately is critical.

They may ask for:

- Social Security benefit statements (SSA-1099)

- Pension or annuity forms (1099-R)

- IRA or 401(k) withdrawals

- Part-time or consulting income (1099-NEC)

3. “If my spouse and I are both over 65, do you need documentation for both of us?”

Important for couples who may qualify for two deductions.

This ensures:

- Both birthdates are correctly recorded

- Filing status reflects joint eligibility

- No assumptions are made based on prior years

4. “Does this deduction change whether you recommend itemizing or taking the standard deduction?”

This helps your preparer optimize the return — not just apply the deduction mechanically.

They may review:

- Property tax and mortgage interest statements

- Medical expense totals

- Charitable contributions

5. “Is there anything I should bring that seniors often forget — even if it seems small?”

This open-ended question often surfaces overlooked items.

Commonly missed:

- Small pension payments

- State tax refunds from the prior year

- Health insurance premium documentation

- Required minimum distribution (RMD) confirmations

Why asking early matters

Many seniors assume age-based deductions are automatic. They’re not wrong — but accuracy matters, especially if income is close to eligibility thresholds or if filing jointly.

Asking these questions before your appointment:

- Reduces back-and-forth

- Prevents last-minute scrambling

- Lowers the risk of leaving money on the table

Why This Matters

For seniors on fixed incomes — relying on Social Security, pensions or retirement savings — every dollar counts. Reducing taxable income before calculating taxes can result in bigger refunds or smaller bills, leaving more money for health care, housing or everyday living expenses.

But it’s not a permanent feature of the tax code. The deduction is scheduled to expire after the 2028 tax year unless Congress takes additional action.

Tax experts also warn that not all seniors will benefit equally. Lower-income individuals whose taxable income is already fully offset by other deductions may see little additional reduction, while high-income filers may see the deduction phase out.

Disclaimer: This article is for general informational purposes only and does not constitute tax, legal, or financial advice. Tax rules and eligibility requirements can change, and how they apply depends on individual circumstances.

Readers should consult a qualified tax professional or financial advisor to understand how current tax laws, deductions, or credits may affect their specific situation.

Sources:

https://www.cbsnews.com/news/senior-tax-deduction-6000-impact-refund-aarp/?utm_source=chatgpt.com