Millions of Americans are paying more for electricity and natural gas — but for older adults on fixed incomes, these increases can be more than just an inconvenience.

According to reporting by CBS News, regulators approved dozens of utility rate hikes across the country last year, pushing billions of dollars in additional costs onto customers’ monthly bills. Most of those increases are already in effect, with more expected in the months ahead.

Behind those headlines is a deeper affordability problem that disproportionately affects seniors.

Seniors falling into the gap

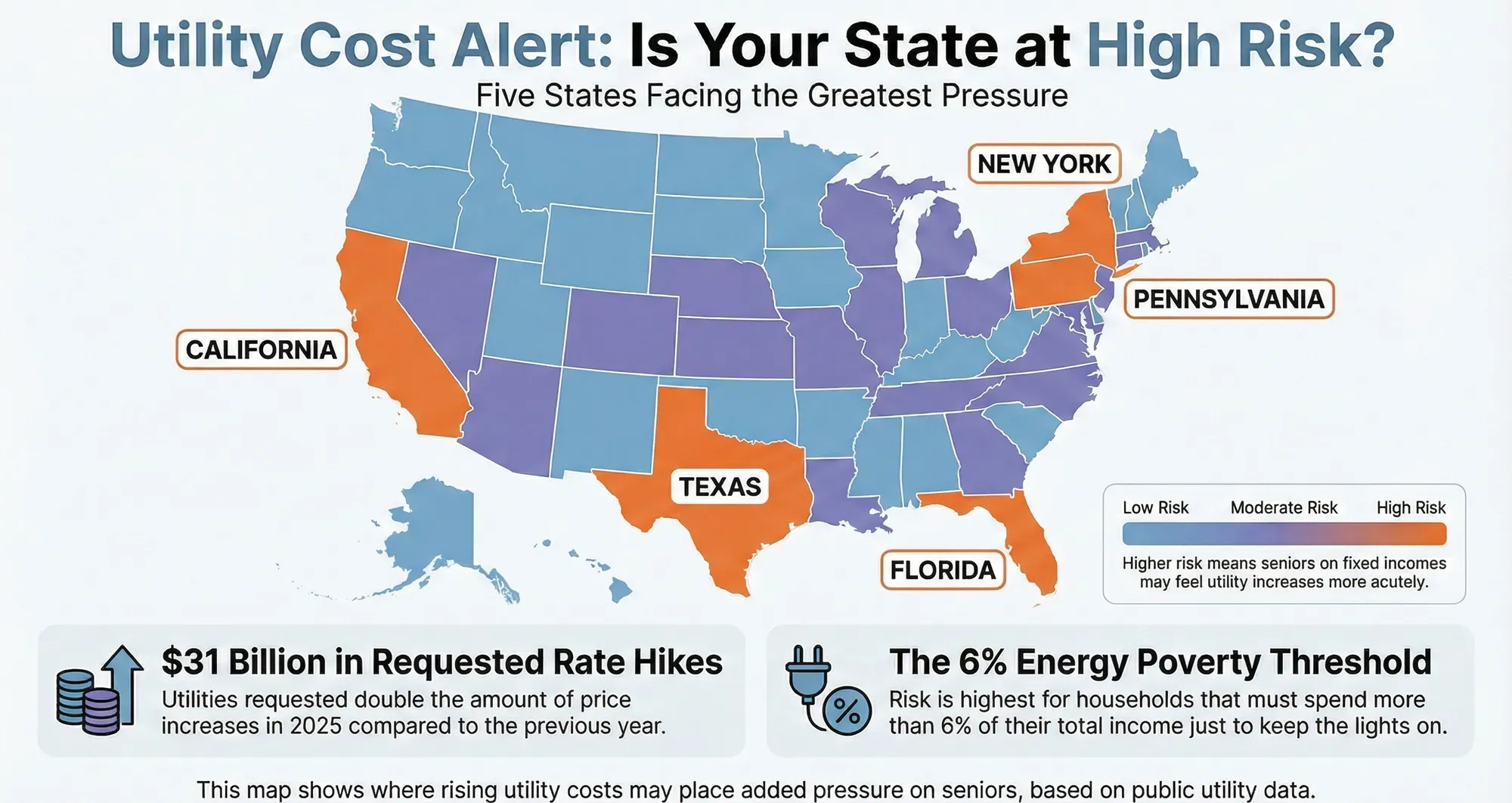

An analysis from PowerLines, a nonprofit that tracks utility costs, found that utilities requested nearly $31 billion in rate increases during 2025, more than double the amount requested the year before. Those requests alone affect more than 80 million Americans, even before all hikes are approved.

Electricity prices have climbed sharply in recent years. Since 2021, residential electricity costs are up about 40%, while natural gas prices have also surged. These increases are now rising faster than overall inflation, outpacing other common expenses like groceries and prescription drugs.

For seniors living on Social Security, pensions, or disability income, that gap matters.

$30-40 a month means real tradeoffs

PowerLines found that nearly one in three Americans struggles to afford their utility bills. Among those affected, many report making uncomfortable — and sometimes unsafe — choices to get by.

More than 50 million households said they kept their homes at unhealthy or unsafe temperatures just to manage costs. Millions more receive disconnection notices each year when bills fall behind.

For older adults, those choices carry added risk. Extreme heat and cold can worsen heart disease, respiratory conditions, and mobility issues. Seniors are also more likely to rely on powered medical devices, making shutoffs especially dangerous.

Lawmakers quoted in the PowerLines report note that even $30 to $40 more per month can force retirees to choose between utilities and essentials like food or medication.

And let's not forget the utility scammers, either. 🥲

What Seniors Should Know Going Forward

The U.S. Energy Information Administration expects residential electricity prices to rise again this year. Natural gas prices may ease somewhat, but experts warn that volatility isn’t going away.

One key takeaway from the PowerLines report: utility bills aren’t automatic.

State public utility commissions decide what utilities can charge. Consumers can submit comments, attend hearings, and in some states, vote for the regulators who approve rate increases.

Many seniors don’t realize they have a voice in this process. But older adults vote at higher rates — and are often directly affected — which gives them real influence when affordability becomes an issue.

Make These Changes Now and Save

Utility bills are rising in part because of aging infrastructure, storm recovery, fuel costs, and growing electricity demand — including the rapid expansion of large data centers in several regions.

Meeting that demand often requires new transmission lines and grid upgrades. And those costs are typically passed along to customers.

Large data centers require enormous amounts of electricity. As utilities work to serve that load, they may need to expand or modernize the grid.

“To serve the growing power load, utilities need to bring electricity from somewhere else, which often requires new transmission lines,” said Saifur Rahman, a professor of electrical engineering at Virginia Tech told Smart Senior Daily.

Seniors can’t control infrastructure decisions. But small changes at home can help lower monthly costs.

Rahman and fellow Virginia Tech engineering professor Scott Dunning recommend practical steps like:

🔽 VA Tech Experts: How Seniors Can Lower or Manage Their Utility Bills Starting This Week

Turn the thermostat down slightly.

If you use a heat pump, setting your winter thermostat to about 68 degrees can reduce heating costs without sacrificing comfort.

Use ceiling fans wisely.

Running ceiling fans clockwise in winter helps push warm air down from the ceiling, making rooms feel warmer at a lower thermostat setting.

Clean refrigerator coils.

Dust on condenser coils forces your refrigerator to work harder and use more electricity. Cleaning them twice a year can improve efficiency and extend appliance life.

Lower your water heater temperature.

Setting it to 120 degrees Fahrenheit is usually sufficient and reduces energy use. Washing clothes in cold or warm water and running full dishwasher loads also saves money.

Ask about a home energy audit.

Many utilities offer free or discounted home energy assessments and rebates on upgrades like smart thermostats, insulation, and energy-efficient appliances.

A simple phone call to your utility asking, “What efficiency rebates or senior programs do you offer?” can uncover savings many people don’t realize are available.

Disclaimer: This content is for general information only and is not intended as financial, legal, or energy-use advice. Utility rates, assistance programs, and billing options vary by state, provider, and individual circumstances.

Availability of discounts, protections, or energy assistance may change over time. Seniors with medical equipment, health concerns, or financial hardship should contact their utility provider, state public utility commission, or a qualified advisor to discuss options specific to their situation.