The Takeaway

- Romance scams often pivot into “investment opportunities” after trust is built

- Tax season confusion is fueling IRS and fake refund scams

- Older adults are disproportionately targeted, according to new research

- Scammers rely on urgency, fear, and secrecy to push quick decisions

- Once money or personal data is sent, recovery is rare

Romance & Investment Scams: When Trust Is the Trap

Many seniors say the scam didn’t start as a scam.

It started as a friendly message. A shared interest. A daily check-in that felt comforting, especially for people living alone or recently widowed.

That’s the hook.

In today’s romance-and-investment scams, criminals create fake online relationships — often over weeks or months — before introducing a “once-in-a-lifetime” financial opportunity. Crypto platforms, foreign real estate, gold investments, or “insider” trading apps are common angles.

The emotional damage can be as devastating as the financial loss.

Victims often report:

- Feeling embarrassed or ashamed to tell family

- Sending money multiple times before realizing something is wrong

- Being urged to keep the relationship — and the investment — secret

Once funds are wired, transferred, or sent via cryptocurrency, recovery is rarely possible.

The scammer doesn’t just disappear. They often stay in contact, inventing reasons the money is temporarily “locked,” and asking for more to “fix” the problem.

Here's how they typically play out...

Tax Season Scams: Playing on Fear and Confusion

Tax season has always been prime time for scammers. But 2026 brings a new wrinkle: confusion.

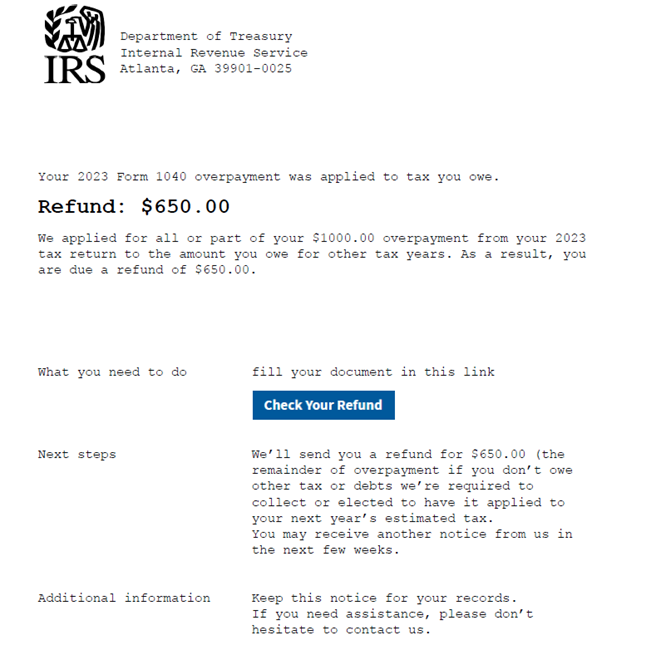

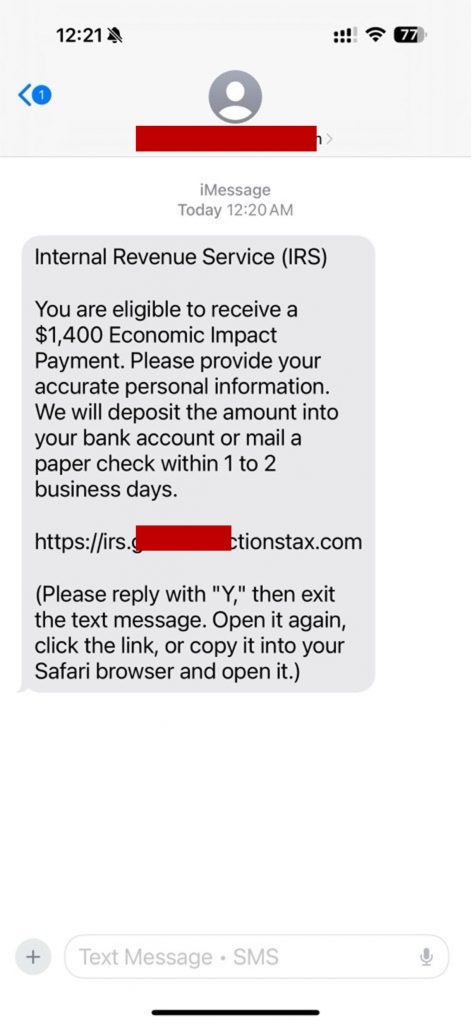

Cybercriminals are impersonating the IRS, tax preparation companies, and even government-backed filing programs — especially as Americans adjust to changes in filing options and services.

According to Trend Micro, this confusion is exactly what scammers are counting on.

“Every tax season we see scammers ramp up their activity,” said Lynette Owens, Vice President of Consumer Marketing & Education at Trend Micro.

“With likely confusion now that the free government-run filing system is discontinued, we’re sure scammers will take advantage.

In past years, we’ve seen fake IRS emails claiming a refund is waiting, text messages warning that an account has been flagged under ‘new rules’ and even offers for fraudulent tax help that promise faster returns.”

The messages are designed to trigger panic.

“These messages are designed to create panic and push people to act quickly,” Owens said. “Older adults and lower-income taxpayers are often targeted, which can lead to serious financial loss or identity theft.”

One reminder bears repeating:

The IRS will never contact you by email, text, or social media.

Any message demanding immediate action is a red flag. Here are three examples:

Why Seniors Are Targeted

Trend Micro research shows older adults are disproportionately targeted in both romance-investment scams and tax scams — and are often less confident in identifying scam warning signs.

Scammers exploit:

- Politeness and trust

- Fear of “getting in trouble” with the IRS

- Desire not to bother family members

- Less familiarity with modern payment systems

That combination can be costly.

What Smart Senior Daily Readers Should Do Now

If you receive:

- An unexpected romantic message that turns financial

- A tax notice urging immediate payment or action

- An offer to “help” you get a faster refund

Stop. Don’t reply. Don’t click.

Talk to someone you trust — before taking action.

And remember: urgency is the scammer’s favorite tool.

Disclaimer: This article is for informational purposes only and does not constitute legal, financial, or tax advice. Smart Senior Daily recommends consulting a qualified tax professional, financial advisor, or trusted authority before responding to any financial or tax-related communication.

If you believe you’ve been targeted by a scam, report it to the FTC at ReportFraud.ftc.gov and your state’s consumer protection office.