If you don't read anything else

- The IRS and state tax agencies do not text or email asking for bank or payment information.

- Scammers often use refund language and urgency to get you to click a link or respond fast.

- Fake tax calls may threaten penalties or offer “help” through made-up programs.

- Always check refund status directly through official IRS tools — never through a link in a message.

- When in doubt, don’t respond. Delete the message and verify independently.

Tax season has a way of putting people on edge. You’re waiting (and hoping) on a refund. You’re worried about deadlines. And right on cue, scam messages start popping up — texts, emails, even phone calls — claiming there’s a problem with your taxes.

Is this year different? In the fact that there's major confusion over whether what we've been told about no tax on Social Security, yes, but most tax pros will tell you that 2026 really is no different.

And one of those things that isn't changing is the litany of tax scams we'll be fighting.

Here are three of the most widespread tax scams circulating right now — explained in plain terms, without the scare tactics.

1. The “Tax Refund Text” Scam

One of the fastest-growing scams arrives as a simple text message.

It claims to be from a government treasury or tax department and says your tax refund is delayed, approved, or at risk. The message often includes a link and instructions like:

“Please provide accurate payment information…”

Here’s the key thing to know: legitimate tax agencies don’t do this.

Tax departments send official notices by U.S. mail. They don’t text you asking for bank details, payment confirmation, or identity verification.

Scammers rely on timing and trust. If you’re already thinking about your refund, the message feels plausible — and that’s the trap.

What to do:

- Don’t reply.

- Don’t click the link.

- Delete the message immediately.

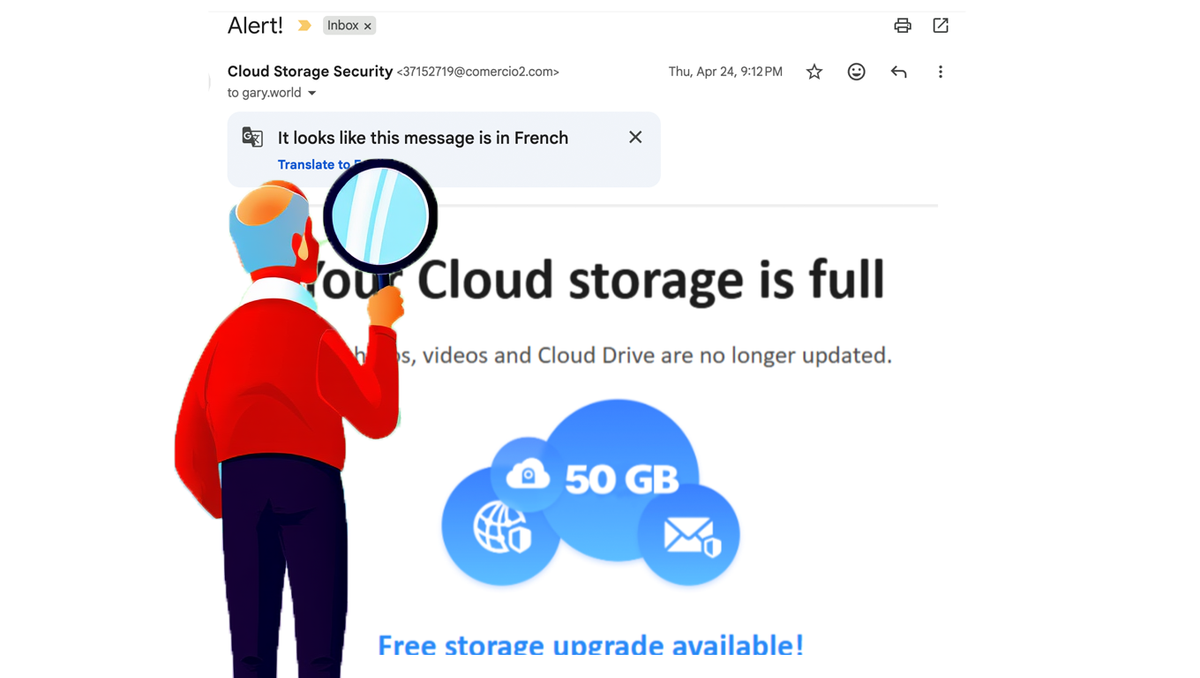

2. Phishing and “Smishing” That Pretends to Be the IRS

As the filing season ramps up, federal consumer watchdogs warn about phishing (email) and smishing (text) scams impersonating the Internal Revenue Service.

These messages often:

- Use subject lines like “Tax Refund Processed” or “Action Required”

- Claim your refund is approved but needs verification

- Ask for Social Security numbers, bank info, or login details

The Federal Trade Commission is blunt about this: The real IRS does not contact taxpayers by text, email, or social media to request personal information.

Another variation involves phone calls. A caller claims you owe back taxes and offers to transfer you to a “tax resolution officer” or special program. The goal is the same — harvesting personal data or payment.

What to do:

- Hang up on unexpected tax calls.

- Never share information based on a call or message you didn’t initiate.

- Verify everything directly through official IRS channels.

3. Urgent Texts Claiming You’ll Lose Your Refund

Another common tactic uses fear and deadlines.

These texts warn that you’ll be disqualified from receiving your refund unless you submit payment or sensitive information by a certain date. They may mention credit cards, payment portals, and often scream “final notices.”

"Urgent refund” texts aren’t about tricking someone into believing the IRS is texting them, Chris Olson, CEO of The Media Trust, tells Smart Senior Daily.

"The cybercriminal is using the text as a doorway. The message is the hook, designed to push seniors onto malicious websites where most tax-season fraud actually lives and spreads."

"Once online, the scam escalates quickly, which is why the most effective defense isn’t just knowing the IRS won’t text you, but refusing to follow any unexpected message onto the Internet and instead checking tax information only through trusted, self-navigated sources."

What to do?

- Treat any urgent tax text as suspicious.

- Don’t click on anything.

- Go directly to an official government website (one ending in .gov) if you need information.

How to Check Your Refund Safely

If you’re waiting on a refund, there’s a safe way to track it.

Use the IRS’s official “Where’s My Refund?” tool. It updates:

- About 24 hours after e-filing

- About four weeks after mailing a paper return

You’ll need:

- Your Social Security number or ITIN

- Filing status

- Exact refund amount

The tool will show whether your return is received, approved, or sent — without risking your personal information.

Put Your Phone to Good Use

Unless you have a burner phone or two tin cans and a length of string, your phone probably has a mechanism where it can screen calls and texts. Use it!

Finally, Report Any and All Tax Scams

If you receive scam messages:

- Use your phone’s “report junk” option

- Forward scam texts to 7726 (SPAM)

- Report abusive tax schemes using IRS Form 14242

Tax scams don’t stop after April. They happen year-round. The safest rule is simple: If a tax message surprises you, don’t trust it.

Disclaimer: This article is for informational purposes only and is not tax or legal advice. For personal tax questions, consult the IRS directly or a qualified tax professional.