The Takeaway

- Washington policy groups are talking about capping annual Social Security cost-of-living raises (COLA) for the top 25% of retirees.

- That means no cut to your benefit, but possibly a smaller yearly increase for higher-earning retirees.

- The line? Roughly $2,400–$2,700 a month in Social Security income.

- Most retirees wouldn’t be affected, but for that top quarter, smaller COLAs could add up over time.

- Advocacy groups, including AARP and The Senior Citizens League, say the proposal punishes older Americans who simply worked longer or earned more.

When Social Security announces its annual COLA, most retirees breathe a sigh of relief. It’s not a raise in the traditional sense — just a little bump to help offset inflation.

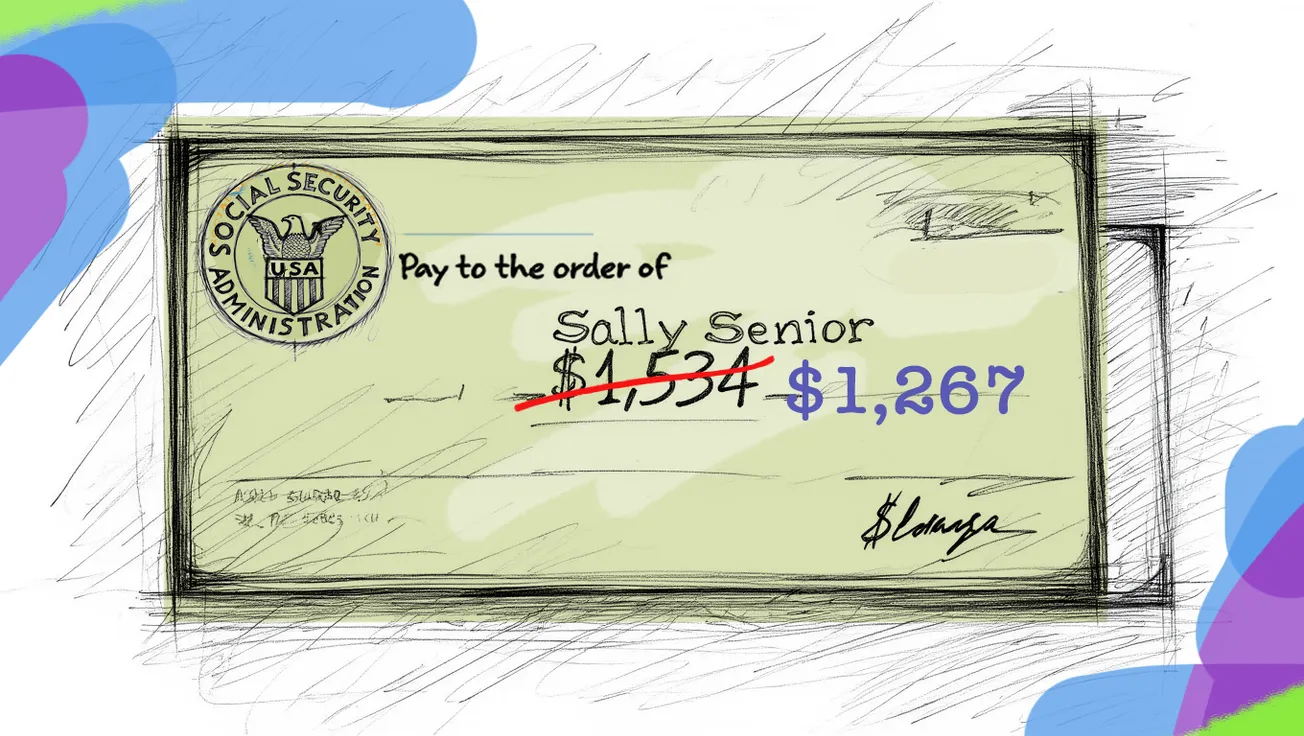

But this year, that good news came with a side of anxiety. Washington budget watchers floated a new idea: cap the COLA for one in four retirees — those with the largest monthly checks.

The suggestion? If you’re in the top quarter of benefit levels, your COLA could be smaller than the inflation rate everyone else gets.

Who Would Be Affected

According to Social Security data, the average monthly benefit for a retired worker is about $1,900.

The “top 25%” — the group likely affected — starts around $2,400 to $2,700 per month, or roughly $29,000–$33,000 a year.

That group isn’t made up of millionaires. It’s largely teachers, engineers, nurses, and career federal or state workers who paid in for decades and often waited until 70 to claim.

Under a COLA cap, their annual inflation adjustment could be trimmed — say, from 2.6% to 2.3%.

It sounds minor, but over ten years, that could total $1,000–$2,000 less in lifetime benefits.

Why the Idea Exists

The concept comes from the Committee for a Responsible Federal Budget (CRFB) — a Washington think tank focused on reducing national debt.

They argue that limiting COLAs for the highest-benefit retirees could help extend the life of the Social Security Trust Fund, which is projected to face shortfalls within the next decade.

Their proposal would protect lower-income retirees, leaving the bottom 75% untouched.

Why Critics Say It’s Unfair

The Senior Citizens League adds that even the current COLAs aren’t enough.

“The 2026 COLA is going to hurt for seniors,” the group said. “Year after year, Social Security’s meager increases won’t be enough.”

— The Senior Citizens League, Oct 2025

And retirement researchers at Boston College caution against changing the formula at all:

“The bundle of goods in the CPI-W does not represent the spending patterns of retirees and therefore understates the inflation actually experienced by older Americans.”

— Alicia H. Munnell, Center for Retirement Research, 2024

In short, critics say: don’t shrink the COLA — strengthen it.

What This Means for You

If your benefit is below $2,400/month, a COLA cap likely wouldn’t touch you.

If you’re above that, your January “raise” could shrink slightly — not disappear, but drop below the inflation rate.

The idea is still just that — an idea — but Washington tends to recycle these proposals whenever Social Security’s finances come up.

So it’s smart to know your benefit level, track inflation, and stay tuned to what advocacy groups are saying.

Quick Reference: What a COLA Cap Could Mean for You

(Based on a 2.6% COLA and a 10% trim for top-tier beneficiaries)

| Monthly Benefit | Normal 2.6% COLA | With 10% Cap Trim | Difference |

|---|---|---|---|

| $1,800 (median) | +$47/month | +$47/month | No change |

| $2,400 (lower edge of top 25%) | +$62/month | +$56/month | –$6/month |

| $2,700 (mid-range top 25%) | +$70/month | +$63/month | –$7/month |

| $3,000 (upper 10%) | +$78/month | +$70/month | –$8/month |

Pro Tip:

A $7 smaller raise might not sound like much, but over 10 years it can mean $1,000 or more in lost benefits — the kind of money that pays for groceries, utilities, or a winter heating bill.

So, treat your annual COLA as a budgeting checkpoint. Review whether it truly covers your rising costs — especially for the essentials in your life.

Disclaimer: This article is for general information only and does not provide financial advice. Any future changes to Social Security must be approved by Congress and may differ from the scenarios described.