The 2026 “Senior Bonus Deduction”: What It Really Means for You

The Takeaway

- Beginning with 2026 returns, older taxpayers get a new break: $6,000 per person over 65.

- It’s in addition to the standard deduction and the age-based add-on you already claim.

- It could reduce or eliminate taxes on Social Security for lower- and middle-income retirees.

- But higher-income seniors may see little benefit — and critics warn it could shrink Social Security’s trust fund faster.

- Experts say now’s the time to revisit your income strategy for 2026 and beyond.

The Basics

Congress tucked the new Senior Bonus Deduction into this year’s broader tax-package deal, and the IRS will begin applying it for tax year 2026.

- $6,000 for single filers age 65+

- $12,000 for married couples if both spouses qualify

It’s layered on top of the regular standard deduction (projected around $15,000 for singles and $30,000 + for couples by 2026) and the existing age-based add-on ($1,650 per person).

That means a typical retired couple in 2026 could see total deductions north of $44,000 before owing any federal income tax.

Before vs. After: Senior Deductions in 2026

Before 2026: ≈ $22,650 (total standard + age add-on)

After 2026: ≈ $28,650 (+ $6,000 bonus deduction)

Estimated Savings: About $600 – $1,000 in federal tax, depending on income mix.

Before 2026: ≈ $33,300 (total standard + age add-ons)

After 2026: ≈ $45,300 (+ $12,000 bonus deduction)

Estimated Savings: $1,000 – $1,800 depending on income sources and filing status.

Starts around $100,000 AGI (single) or $200,000 (joint). Above that, the bonus gradually disappears.

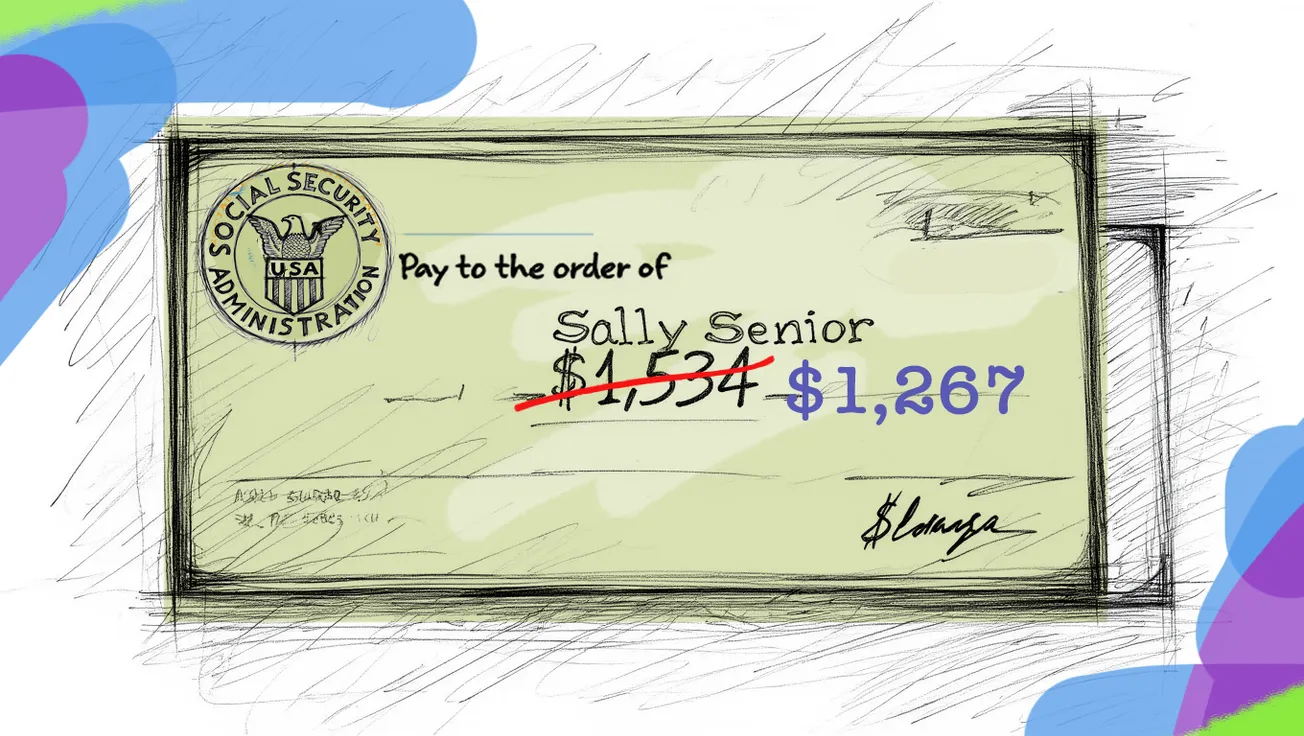

When stacked with standard and age add-ons, many modest-income retirees will drop below the threshold for taxable Social Security benefits — meaning little or no federal income tax due in 2026.

Who Benefits Most

This bonus mainly helps retirees living on modest incomes — those with Social Security plus small pensions, annuities, or IRA withdrawals.

Example 1

A single filer with $32,000 in total income:

- $25,000 from Social Security

- $7,000 from IRA withdrawals

After subtracting the combined deductions (roughly $22,000 standard + $1,650 age add-on + $6,000 bonus = $29,650), only a few thousand dollars remain taxable. That’s typically below the threshold where Social Security benefits become taxable at all.

Result: $0 federal income tax.

Example 2

A married couple (both 65+) with $60,000 in total income:

- $45,000 from Social Security

- $15,000 from IRA withdrawals

Their combined deductions (≈ $30,000 standard + $3,300 age add-ons + $12,000 bonus = $45,300) wipe out nearly all taxable income.

Result: a small federal liability or none at all — depending on state taxes.

Who may not benefit

The deduction phases out for higher-income seniors — generally those with adjusted gross income above roughly $100,000 (single) or $200,000 (joint).

- These retirees already itemize or exceed the taxable thresholds.

- Some experts note that while this delivers relief at the low end, it doesn’t offset inflation-driven Medicare premiums or housing costs for middle-income seniors.

The Trade-offs

According to the Washington Post and Tax Foundation analyses, the change could reduce federal revenue by $63 billion over 10 years — much of it coming from the Social Security payroll and benefits side. Critics warn that it could advance the projected depletion date of the trust fund by a year or more.

Supporters counter that it delivers long-overdue relief to retirees squeezed by higher food, energy, and housing costs.

What Seniors Should Do Now

1. Revisit your 2026 tax plan early.

If you take required minimum distributions (RMDs), you might be able to adjust withdrawal timing to stay under the new taxable thresholds.

2. Review withholdings or estimated payments.

If you typically owe each April, this change might let you cut back your quarterly payments.

3. Coordinate with state taxes.

Some states tax Social Security; others don’t. The federal deduction doesn’t automatically flow through to your state return.

4. Consider Roth conversions before 2026.

Reducing taxable income in retirement years can make the new deduction even more advantageous.

The Bigger Picture

This new deduction arrives as Social Security and Medicare finances face fresh scrutiny — and as Congress weighs whether to make several 2017 Tax Cuts permanent. For many older Americans, the 2026 rules could be the most generous in years — or the start of a new round of political fights over who deserves relief.

Sources: Washington Post, Tax Foundation, IRS.gov, KFF.

Disclaimer: This article is for general informational purposes only and should not be taken as financial or tax advice. Seniors should consult a qualified tax professional or financial advisor before making any filing decisions.