A new analysis sent to Smart Senior Daily from Consumer Reports paints a bleak picture of the Consumer Financial Protection Bureau (CFPB) one year after it was first ordered to halt most of its work.

Consumer Reports says the agency still technically exists — but its ability to protect everyday consumers has been severely weakened.

According to the report:

In early 2025, staff at the Consumer Financial Protection Bureau were ordered to stop nearly all work, including supervision of banks and financial firms. Since then, the agency’s enforcement power has thinned dramatically.

More than 40 cases were dropped or scaled back — including actions that could have returned over $3 billion to consumers. Staffing was cut sharply, especially in enforcement, and oversight of payment apps, online lenders, and other non-bank financial services was deprioritized.

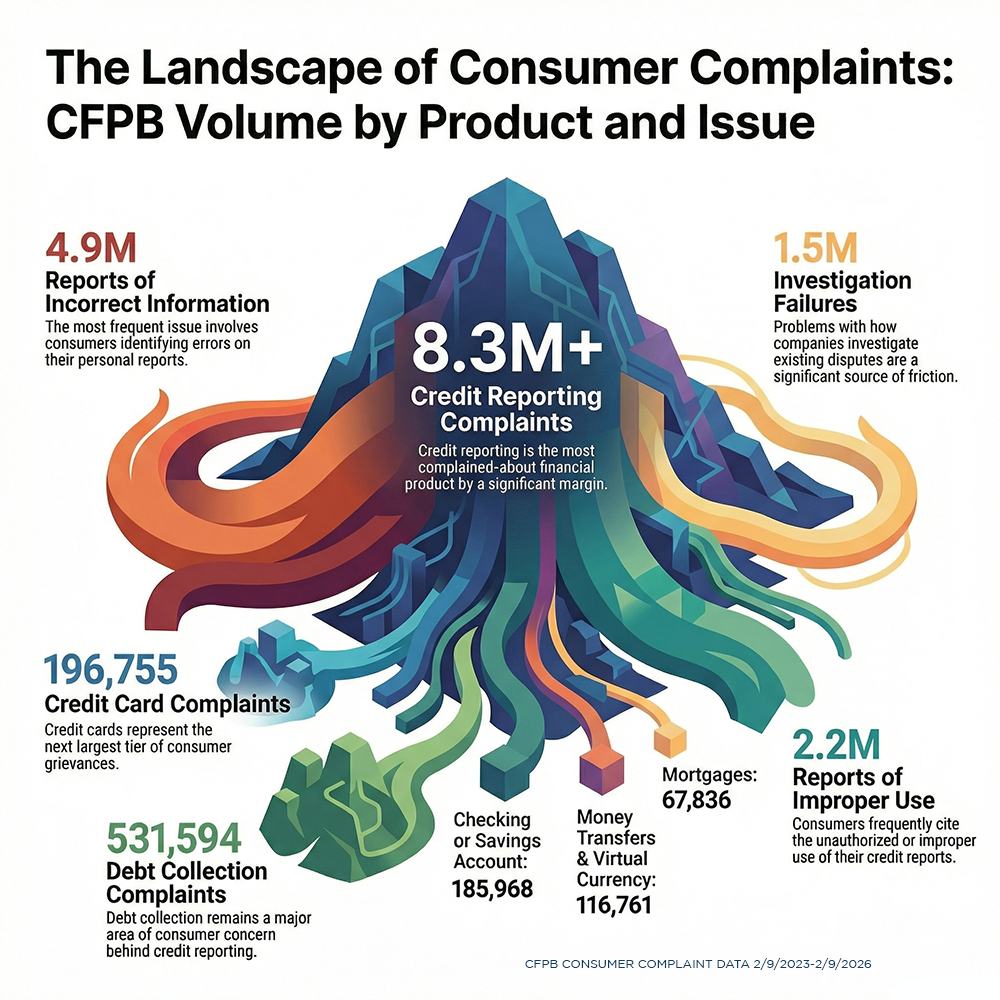

The Bureau also withdrew guidance on issues like discriminatory lending, abusive debt collection, and medical debt reporting. Efforts to curb excessive late fees and overdraft charges were abandoned, funding was reduced, and its complaint system now faces a backlog of more than 800,000 unresolved cases.

“The CFPB may still be standing, but it's essentially on life support,” said Chuck Bell, advocacy program director at Consumer Reports.

"Dismantling the CFPB sends the message that it’s open season on consumers because the financial cop that was created by Congress to protect our wallets from unscrupulous financial firms has been taken off the beat."

Consumer Reports’ bottom line: without an active CFPB, banks and financial companies face less pressure to correct harmful behavior, and consumers have fewer protections when things go wrong.

What this means specifically for seniors

This matters to all consumers — but seniors are hit harder than most.

Here’s why.

1. Fewer forced refunds and corrections

Many of the dropped cases involved issues seniors complain about most:

- Savings accounts paying less than advertised

- Fraud losses on payment platforms like Zelle

- Deceptive overdraft or late-fee practices

When enforcement disappears, refunds don’t happen automatically — even when companies acted unfairly.

2. Complaints may carry less weight

The CFPB complaint portal has long been a last resort for seniors who’ve tried everything else.

With fewer staff:

- Complaints may take longer to process

- Companies may feel less urgency to respond

- Seniors may have to push harder to get answers

3. More exposure to junk fees

Rules that would have saved consumers billions in overdraft and late fees are gone or stalled.

For seniors on fixed incomes, even small recurring fees can quietly drain monthly budgets.

4. Less oversight of digital money tools

Payment apps, online lenders, and “bank-like” services run by tech companies are seeing less scrutiny.

That’s risky because:

- Seniors are often pushed into using these tools

- Fraud protections vary widely

- Resolving disputes can be confusing or slow

5. Greater need for self-protection

With fewer regulators “on the beat,” Consumer Reports warns that consumers — especially older adults — may need to be more vigilant than before.

"Without the CFPB standing up for consumers and taking on the big banks and predatory lenders, we’re all more vulnerable to abusive financial practices and costly fraud and scams," Bell said.

Bottom line for seniors

Consumer Reports isn’t saying protections are gone — but it is saying the safety net is thinner.

For seniors, that means:

- Watch bank and credit card statements closely

- Question unexplained fees or changes immediately

- Keep filing complaints — even if responses are slower

- Be cautious with payment apps and new financial tools

- Don’t assume regulators will automatically step in

This isn’t about panic.

It’s about awareness — and knowing that, for now, the burden of catching problems may fall more heavily on consumers themselves, especially older ones.

Source note: This article is based on analysis and data provided to Smart Senior Daily by Consumer Reports, along with publicly available court filings and policy documents.

Disclaimer: This article is for informational purposes only and is not intended as legal or financial advice. Consumer protection rules, complaint processes, and available remedies vary by state and individual situation. Seniors facing suspected fraud, financial abuse, or complex disputes should consider contacting their state consumer protection office, a qualified attorney, or a trusted financial professional for guidance specific to their circumstances.