As we get into the groove of 2026, more older Americans are quietly doing something that used to feel unusual: going back to work.

Sometimes it’s about money. Sometimes it’s about purpose. Often, it’s both.

What hasn’t changed is this: working while collecting Social Security can reduce your monthly benefit — at least for a while — if you don’t understand the rules.

Both the Social Security Administration and AARP are urging retirees to pay attention to new 2026 earnings limits before assuming an extra paycheck is “free money.”

The core rule (still misunderstood)

You can work and collect Social Security at the same time.

But if you haven’t reached Full Retirement Age (FRA), the SSA may temporarily withhold part of your benefit if your earnings go over certain limits.

And those limits changed for 2026.

“Don’t want to work full-time?” personal finance reporter Kerri Anne Renzulli wrote for AARP. “Consider picking up part-time work that would allow you to customize your workload and maintain time for other activities or goals that are important to your retirement lifestyle.”

The 2026 Earnings Limits — Plain English Version

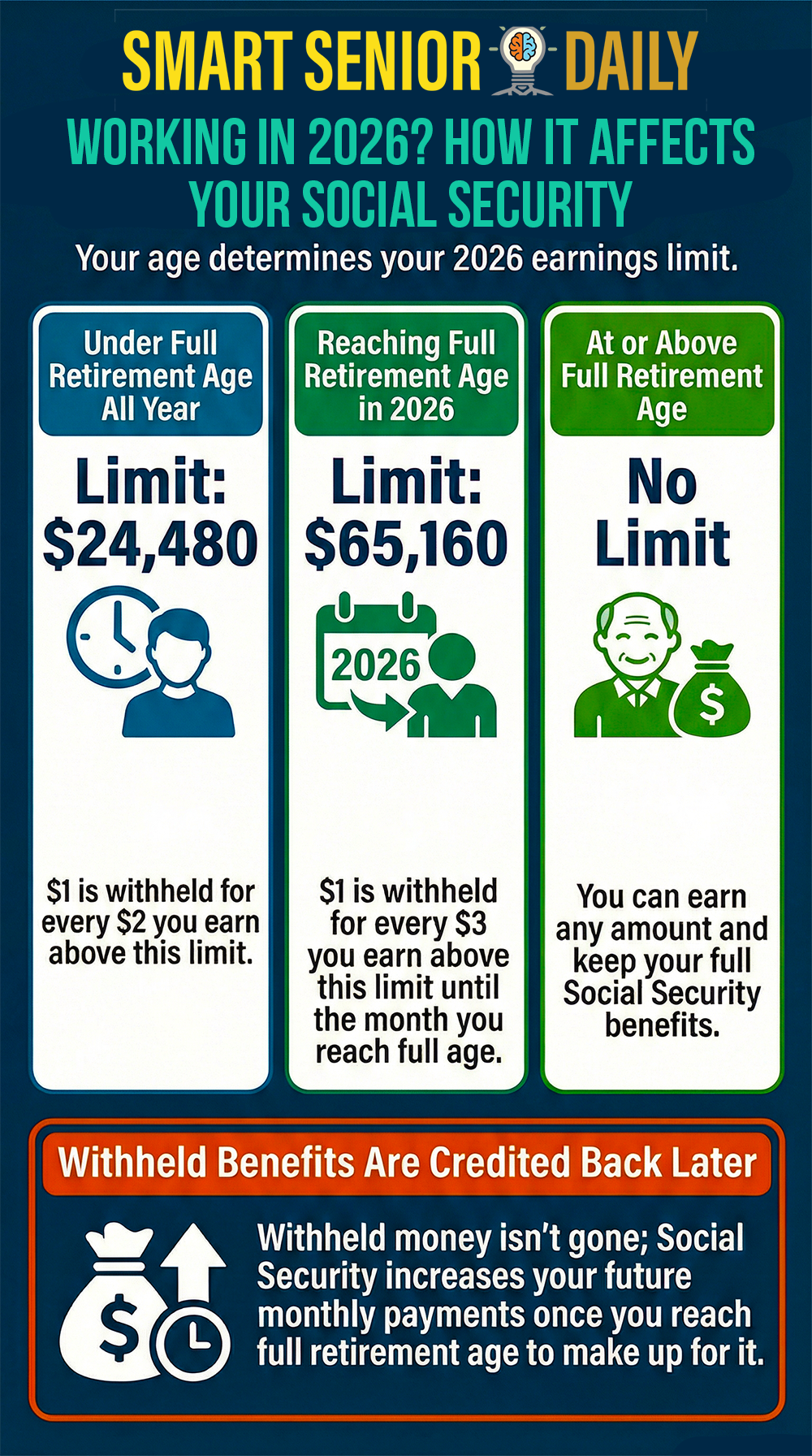

Here’s how it breaks down, depending on your age.

If you’re under Full Retirement Age all year

- You can earn up to $24,480 in 2026

- That’s $1,080 more than in 2025

- Penalty: SSA withholds $1 in benefits for every $2 you earn above the limit

If you reach Full Retirement Age sometime in 2026

- You can earn up to $65,160 before the month you hit FRA

- That’s $3,000 more than in 2025

- Penalty: SSA withholds $1 for every $3 earned above the limit

- Only earnings before your birthday month count

Once you reach Full Retirement Age

- There is no earnings limit

- Your benefits are no longer reduced, no matter how much you earn

One important detail people miss: money withheld isn’t “lost.”

The SSA later recalculates your benefit and credits back those months once you hit FRA.

Or if you'd prefer a graphic explanation...

Why retirees are working anyway

Money is the biggest driver — but it’s not the only one.

According to research cited by AARP and T. Rowe Price, nearly half of older adults who continue working say financial pressure plays a role. Almost as many say they do it for social, emotional, or mental health reasons.

And most aren’t going back to full-time careers.

Instead, retirees are choosing:

- Part-time or seasonal roles

- Consulting or contract work

- Flexible gig jobs with platforms like Uber, DoorDash, or Postmates

- Remote or hybrid work that fits around health and family needs

The key is knowing how much is “safe” to earn before benefits are affected.

Disclaimer: This information is provided for general educational purposes only and is not intended as legal, tax, or financial advice. Social Security rules can change, and how earnings affect benefits depends on individual circumstances, including your age, work status, and type of income. Always verify details with the Social Security Administration or consult a qualified financial or tax professional before making decisions about working while receiving Social Security benefits.

Sources:

https://www.aarp.org/money/retirement/ask-before-you-unretire/

https://www.ssa.gov/benefits/retirement/planner/whileworking.html