For more than 70 million Americans, this morning’s announcement from the Social Security Administration was one of the most anticipated of the year.

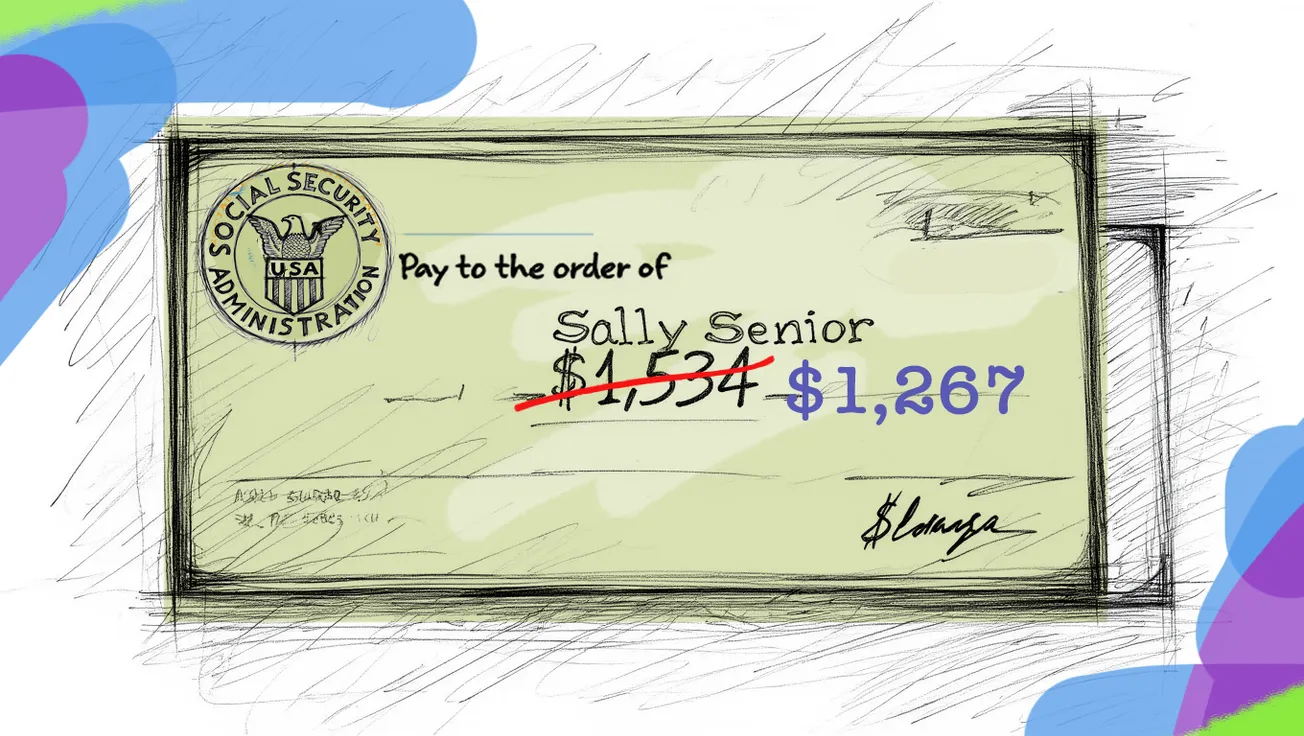

Beginning January 2026, monthly Social Security payments will rise 2.7% — an average boost of about $54 per month (roughly $648 a year) for a typical retiree.

That’s a modest increase compared to last year’s 2.5%, but one that still trails the pace of inflation in housing, groceries, and medical care. For most seniors, it’s a welcome but bittersweet adjustment: enough to notice, not enough to stretch.

What Changes in 2026

| Category | 2025 | 2026 | What It Means for You |

|---|---|---|---|

| Cost-of-Living Adjustment (COLA) | 2.5% | 2.7% | Benefits will rise automatically starting in January 2026. |

| Average Monthly Increase | — | ≈ $54 ($648/year) | Based on average retirement benefit of ~$2,008/month. |

| SSI Payment Start Date | Dec 31 2024 | Dec 31 2025 | Earlier than Social Security benefits (which begin in January). |

| Taxable Maximum Earnings | $176,100 | TBD (expected increase) | Higher-income earners will contribute more in Social Security tax. |

| Earnings Limit (Below Full Retirement Age) | $23,400 | ≈ $23,900 (expected) | You lose $1 in benefits for every $2 earned above this limit. |

| Earnings Limit (Reaching Full Retirement Age) | $62,160 | ≈ $63,000 (expected) | You lose $1 for every $3 earned over this amount. |

What “Earnings Limit” Really Means

If you’re still working and collecting Social Security before you reach your full retirement age, the government temporarily withholds part of your benefit if you earn over a certain amount.

For 2025, that limit is $62,160 — expected to rise to about $63,000 in 2026. Here’s how it works:

If you earn more than that amount in the months before you reach full retirement age, Social Security will hold back $1 in benefits for every $3 you earn over the limit.

Example:

Let’s say you turn full retirement age in October 2026 and earn $69,000 from your job before your birthday. That’s $6,000 over the limit.

Social Security will withhold about $2,000 in benefits for the year ($1 for every $3 over).

Once you hit your full retirement age, the limit disappears. You can earn as much as you want, and your monthly benefit will be adjusted to give you credit for any months that were withheld.

In short: It’s not a fine — it’s a temporary holdback. You’ll get the money back later once you reach full retirement age.

When You’ll See the Increase

- SSI beneficiaries will receive their first boosted payment on December 31, 2025.

- Social Security recipients will see the increase reflected in January 2026 payments.

- Personalized COLA notices will appear in the Message Center of your My Social Security account in December 2025 — and for the first time, the SSA says the notice will be simplified to one page, with clear language and exact payment amounts.

Pro Tip:

If you still get paper checks, switch to direct deposit at GoDirect.gov. It’s faster, safer, and ensures you’ll get your new benefit amount on time.

GoDirect.govHow the COLA Is Calculated

Each year’s adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — comparing average prices in July, August, and September of the current year to the same months the year before.

In plain English: when everyday costs rise, benefits follow — but with a one-year lag, and never quite fast enough to match real-world inflation.

What Seniors Should Do Now

- Check your My Social Security account — your personalized 2026 notice will arrive there in December.

- Plan for Medicare changes. Premiums for Part B are projected to rise, which could eat up part of your increase.

- Review your budget. Rising costs for housing, utilities, and food may still outpace your COLA.

- Stay alert for scams. The SSA never calls, emails, or texts asking for money or personal info. Always go directly to ssa.gov/myaccount.

The Bottom Line

This year’s increase is a lifeline — but not a windfall. The 2026 COLA will help offset higher prices, yet it won’t erase them. For many retirees, it’s another reminder that “fixed income” doesn’t mean fixed expenses.

Disclaimer: This information is for general educational purposes only and does not constitute financial or legal advice. Individual benefit amounts and deductions vary. For exact figures, log in to your My Social Security account or speak with a qualified advisor.